Banks

Banks are important financial institutions which allow clients to borrow and lend (in the case of commercial banks), or issue equity, raise debt, provide advice on mergers and acquisitions, and act as brokers (in the case of investment banks).

Given how diverse the activities undertaken by banks are, it is not surprising that the risks they face are just as varied, facing 3 large categories of risk:

- Market risks. These are the risks caused by movements in the price of various assets in the free markets and can be further sub-divided into equity risk, interest rate risk, exchange rate risk, and commodity risk.

- Credit risks. Everything related to creditworthiness belongs to this category, whether it’s default risk, solvency risk, or settlement risk.

- Operational risks. Last but not least is the category of operational risks, which refers to losses from inadequate internal processes. There have been numerous cases of banks losing billions of dollars due to rogue traders and/or glitches in their systems.

Economic Capital vs Regulatory Capital

The high rate of failures among banks has prompted regulators to enforce capital requirements for banks to keep for unexpected events. These requirements can be classified as economic capital requirements and regulatory capital requirements.

Economic capital is the amount of liquid capital a bank estimates will need in case of unexpected losses, based on the bank’s own internal models. Regulatory capital is the amount of liquid capital that a regulator thinks a bank is required to hold to absorb unexpected losses, based on standardized models. Obviously, the two may be quite different. Whilst a bank is incentivised to hold some economic capital to maintain a high credit rating, competitive pressures may force it to lower this capital to deploy it somewhere else to increase its immediate profitability. If all banks lower their economic capital requirements, it increases the systemic risk of the entire banking system, which regulators deem unacceptable.

Basel Committee regulations

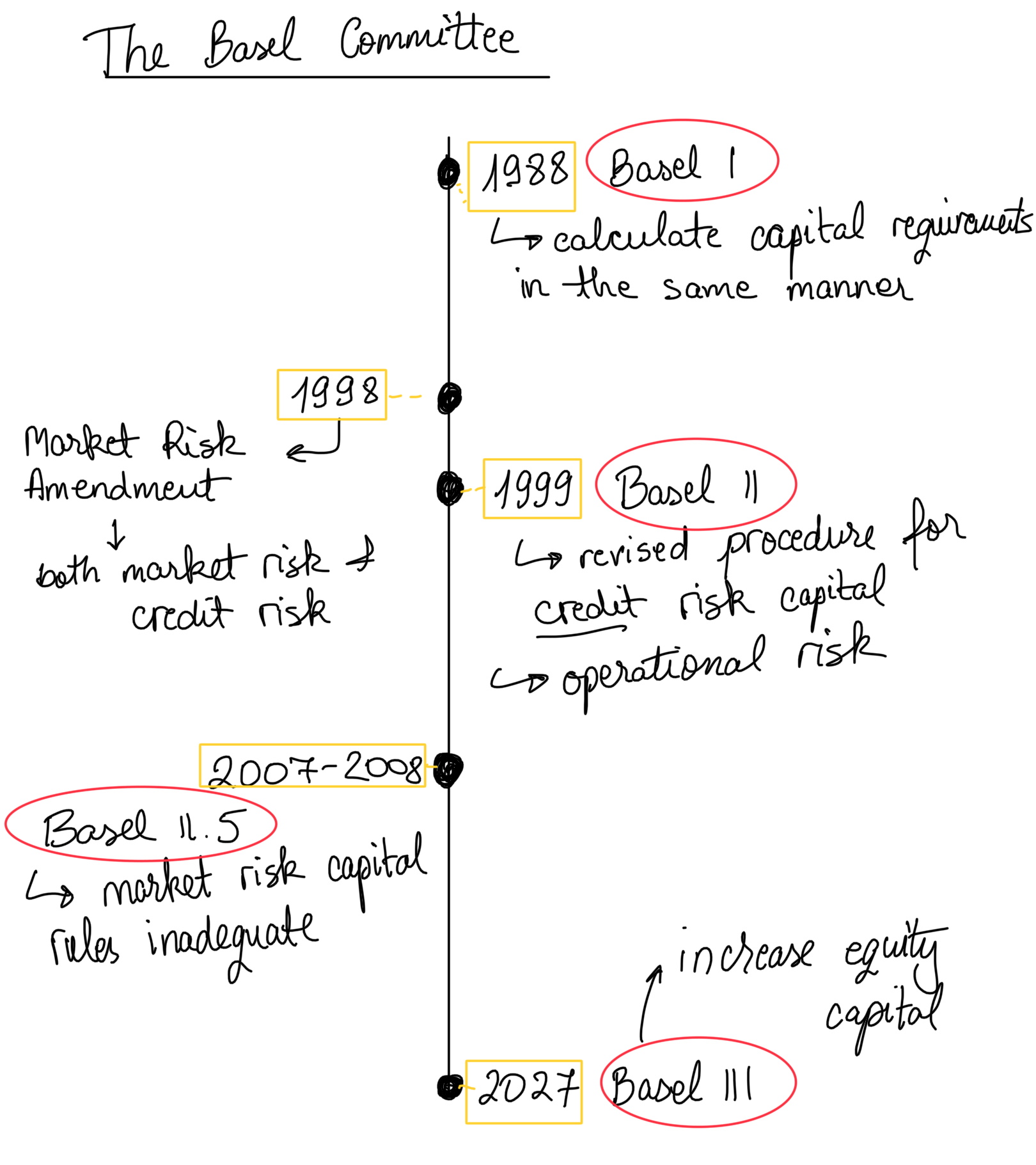

The Basel Committee created a series of regulations that each signatory country should follow, in order to simplify and standardize their capital requirements calculations.

In 1988, Basel I was the first agreement that capital requirements should be calculated in the same way, with a focus on credit risk. Ten years later, in 1998, the Market Risk Amendment stated that market risk and credit risk need to be taken into account separately. One year later, in 1999, revised the procedure for credit risk capital calculations and introduced operational risk as another category that needs to be accounted for separately.

Finally, the required capital of a bank is computed as:

|

|---|

| Basel Committee Guidelines Timeline |

It also introduces a few new ratios, such as a Leverage Ratio (for leverage), the Liquidity Coverage Ratio (for liquidity), and the Net Stable Funding Ratio (for maturity mismatches).

Moral hazard

Moral hazard is the risk of insured parties taking more risks, knowing that if losses occur, they would be compensated under their insurance policy. When incentives are not properly aligned, insurance can lead to insurance companies being worse off. For example, in the U.S. the is deposit insurance against losses of up to $250,000, which means that banks can be more aggressive in their capital allocations, because they know they will be bailed out.

Investment banking financing arrangements

Investment banks help companies raise equity or debt via a number of arrangements such as private placements, public offerings, best efforts or firm commitments, or auctions (e.g. Dutch auctions).

Private placements are arrangements where equity is sold just to institutional investors, without including the general public. Public offerings are similar, but open to the general public.

When raising equity for a client, an investment bank may offer certain guarantees about the price of the shares. Such a commitment, called a firm commitment, entails the investment bank guaranteeing a certain share price for the client, buying the shares if they are at lower than the agreed price. This approach will be advantageous to a client who wants to lock-in a minimum share price. However, if the share price is higher than the agreed price, the investment bank will be at a profit.

The other approach is a best efforts offering, in which the investment bank doesn’t offer any guarantee about the share price. While not as predictable as the firm commitment approach, it may be advantageous to clients in the case of a share price increase.

Finally, a Dutch auction may be used when the price discovery is to be done using game theoretical mechanisms. In a Dutch auction, prospective investors interested in buying the shares in the equity offering will independently and secretly specify the price and amount of shares they are interested in buying. Then, they are sorted by the offered share price, from highest to lowest. The prevailing bid price will be the minimum bid price such that the amount of shares on offer is covered by the participants. This will result in the highest price being paid for the shares.

Conflicts of interest

Conflicts of interest may arise if a bank has both an investment bank arm and a commercial bank arm.

For example, an investment banker may be advising a client who wants to take over another (target) company in a hostile manner. The target company may have loans at the commercial banking arm, therefore giving the investment banker the chance to ask for information about the financial situation of the target company, provided no restrictions are available.

Another example involves a company at risk of default. The commercial banking arm may ask the investment banking arm to convince its clients to finance debt for this company, effectively subsidising the credit risk.

To solve these conflicts of interest, the senior management of the banks must enforce Chinese walls between these departments, and encourage a healthy risk management mentality, emphasising the important role a good reputation plays to the success of a bank.

Banking book vs Trading book

The banking book refers to the book which contains assets to be held to maturity by the bank. For example, loans belong to the banking book and are subject to credit risk capital requirements.

The trading book refers to the book with assets to be actively traded, are not held to maturity, and are subject to market risk capital requirements.

The difference between the two is important from a regulatory point of view, because they have different capital requirements. Banks often are incentivized to put ambiguous items (such as credit derivatives) to the book which would entail the least amount of capital.

Originate-to-distribute banking models

The originate-to-distribute banking model played an important role in the financial crisis of 2007-2008. Not only that, it has many elements of clever financial engineering. I will cover it in another post, but at a high level, the original-to-distribute model has two stages.

In the first stage, the bank source loans (e.g. mortgages, auto loans, consumer credit loans, etc…). Then, in the second stage, these are packaged into tranches of varying riskiness, which are then sold to investors.